25 Jul 2023

Mileage Claim

Is it a benefit in kind or a reimbursable expense?

If there’s one subject that is destined to cause confusion in the expenses world it’s mileage claims. We’ve put together 5 things you need to know about mileage allowance payments to make things easier.

- Mileage Allowance Payments (MAPs) are what you pay your employee for using their own vehicle for business journeys. You’re allowed to pay your employee a certain amount of MAPs each year without having to report them to HMRC. This is called an ‘approved amount’

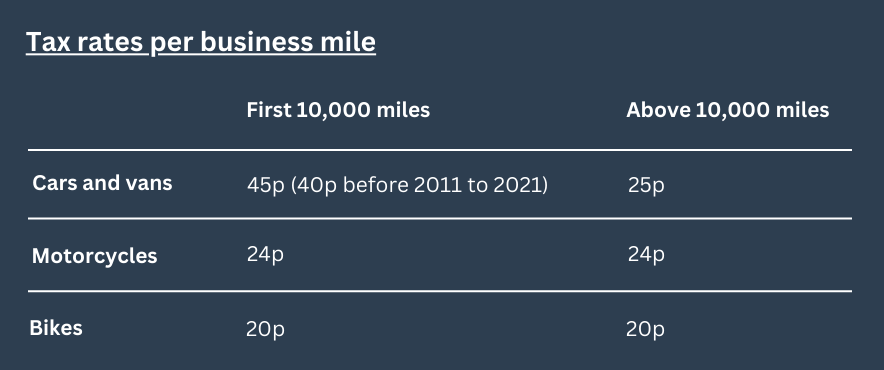

- To calculate the ‘approved amount’, multiply your employee’s business travel miles for the year by the rate per mile for their vehicle. Rates below:

- If an employee carries another employee in their own car or van on a business journey, you can pay them passenger payments of up to 5p per mile tax-free in addition to the rates above.

- Employees will need to log the following for each trip: date a purpose of the trip, total distance travelled and the start and end address of the trip.

- Anything above this approved amount must be reported on a P11D as it is a deemed benefit. This will then be liable for Class 1A National Insurance to be paid by the employer. Deadline for submission of P11D is 6th July each year.