VAT Overview on Buildings and Construction

This blog is designed to give a brief overview of the VAT implications of supplying goods and services to the residential construction industry.

New build properties

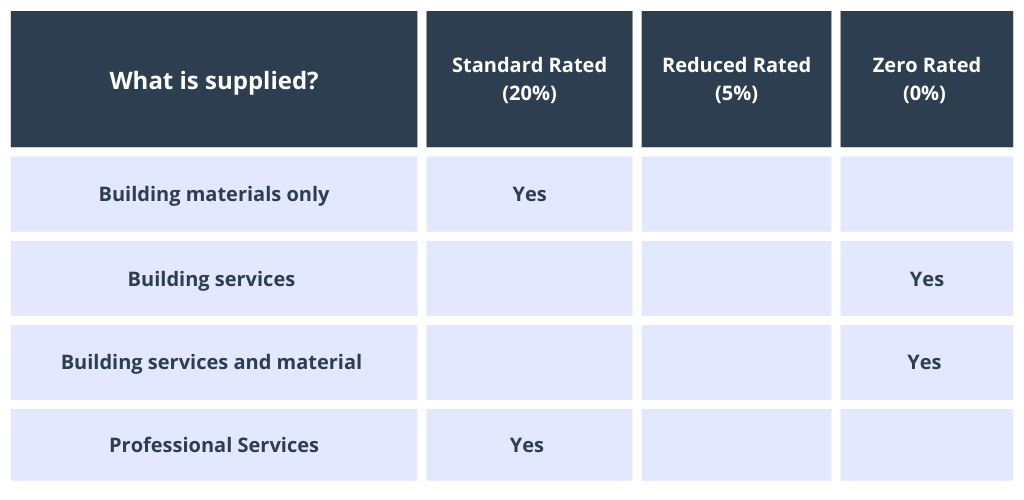

In the case of a new build on an existing property site, HMRC’s definition of a new build is very strict and requires all existing structures to be demolished in their entirety, subject to certain exceptions. The table below is an overview of the VAT treatment for the supply of building goods or services to a new build:

Conversion of a property

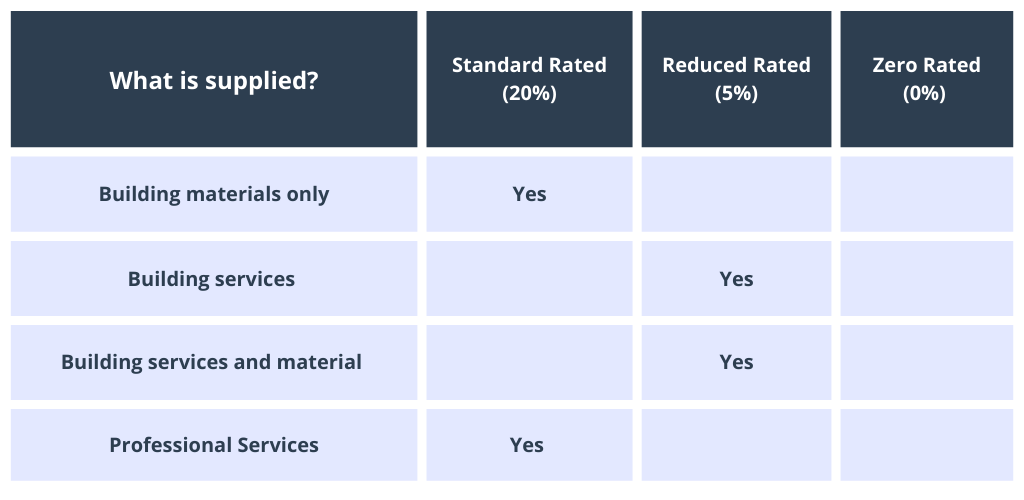

HMRC defines the conversion of a property as a fundamental alteration of a building, for example the conversion of a warehouse to flats. The table below is an overview of the VAT treatment for the supply of goods or services to the conversion of a property, although exceptions apply:

In certain circumstances, building services and materials can qualify for Zero-Rating. In short, if the company developing the property could be granting a major interest in the property to a third party then this may result in the work qualifying for Zero-Rating. A major interest is defined by HMRC as either the sale of property or a grant of a new lease no less than 21 years.

Renovation and redecoration of a property

HMRC defines renovation as repairing or restoring a property and redecoration as the general update or alteration of a property, such as the installation of a new kitchen. The supply of goods and services for renovation and redecoration works is standard-rated (i.e. VAT at 20%).

Approved alterations to protected buildings

From 1st October 2012 the supply of goods and services with regards to approved alterations to protected buildings are no longer zero-rated and are now standard rated (i.e. VAT at 20%).

Extension of an existing property

The definition of an extension is the enlargement of an existing property. The supply of goods and services for extension works is standard-rated (i.e. VAT at 20%).