7 Things You Must Know About Auto Enrolment

What’s automatic enrolment about?

Automatic enrolment is a government initiative to help more people save for later life through a workplace pension scheme.

It started with laws introduced in 2008 which have been phased in starting with large employers from 2012.

All employers have a legal duty to offer an auto enrolment pension scheme to their employees.

Choosing a pension scheme

Not all pension schemes are suitable for automatic enrolment so choose wisely!

Important factors to consider are:

- Cost – Some scheme providers will be more transparent than others in terms of costs, both to employers and employees. It is important to make sure these are fully understood.

- User friendly – All schemes require an element of data transfer to their systems so you should factor in the complexities of doing so when researching the options,

- Customer service – You are bound to have questions and encounter the odd hurdle so it is important that answers and solutions are not far away.

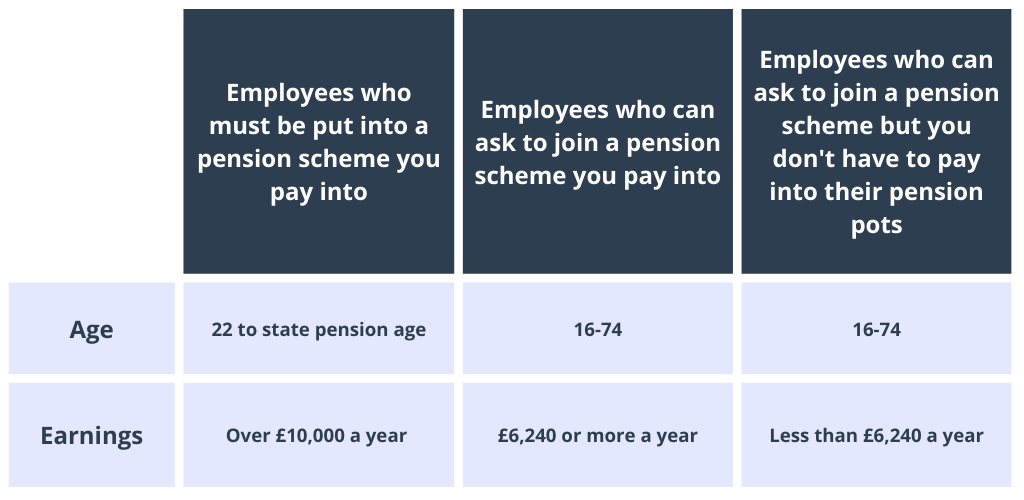

Working out who to put into the pension scheme:

Most payroll software works this out for you but if in doubt call in the professionals. Your payroll providers or accountants are a good place to start.

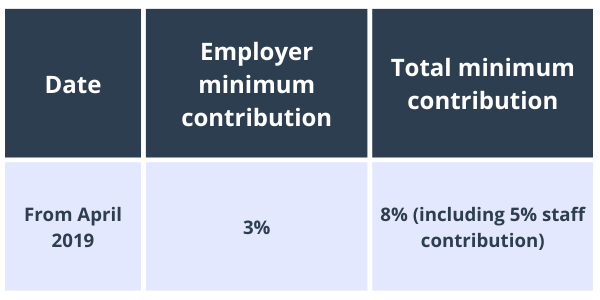

How much do you need to pay into employee pension pots?

Minimum contributions will be calculated at the below percentages on the employees’ qualifying earnings (currently between £6,240 and £50,270).

Writing to your employees

As an employer you must write to your employees explaining automatic enrolment and their rights and obligations.

Providing a Declaration of Compliance

You need to inform The Pensions Regulator that you have complied with your auto enrolment duties as an employer within five months of your staging date, otherwise you could be fined.

Keeping on top of your ongoing duties

Monitor your employees ages and earnings to see if anyone needs to be added to the pension scheme. If your payroll software already monitors ages and earnings, then it should flag this up. You need to keep records of all your staff for 6 years.

Every three years, an automatic re-enrolment takes place and employees who have ceased active membership are automatically re-enrolled into their workplace pension scheme.

Checklist

You must:

- Automatically enrol eligible employees into a pension scheme and pay into their pension pots.

- Provide a declaration of compliance to the Pensions Regulator for the scheme every three years.

- Keep records of all leavers/opt outs for four years.

- Keep records for each employee for six years.

You must not:

- Encourage or force employees to leave/give up membership of the pension scheme