Enterprise Management Incentive (EMI) Scheme

EMI schemes are a tax and cash-flow efficient way of incentivising and retaining key staff by offering them a stake in your business in return for their loyalty and performance.

How do they work?

Selected staff are issued with qualifying share “options”, giving them the opportunity (but not obligation) to buy shares at a predetermined point in the future for a price set now. This opportunity can be dependent on the meeting of certain performance and/or time related objectives.

What are the tax advantages?

The life cycle of share options can be drawn diagrammatically as:

1 Grant of option –> 2 Exercise of option –> 3 Sale of shares

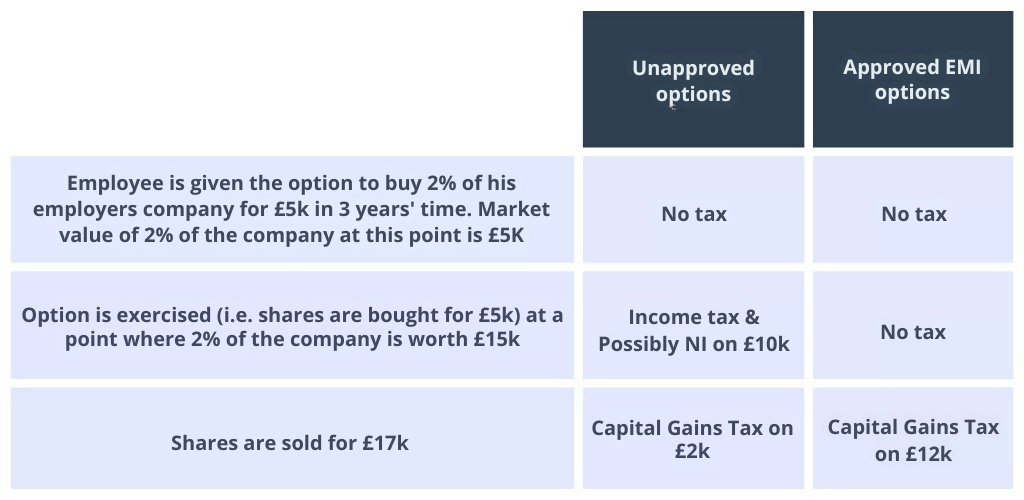

The best way to demonstrate the tax advantage of share options qualifying for EMI is through a basic worked example:

Whether a share option is approved or not then, you can see from the above example that the employee will be taxed in some shape or form on the full difference between the price he buys the shares at and the price he sells them at (£12k in the example above).

However, on the assumption that the options are not granted at a discount to the market value of the shares at stage 1 (see below), the significant advantages of the options qualifying under the EMI are:

- If the EMI options are granted at discount, income tax is also due at the point of exercise, on the difference between the amount paid per share and the market value of the option at the point of grant.

- No tax will be payable until the shares are sold (stage 3) and the profit on them is realised (i.e. the employee will have received the cash on which they are paying tax before they have to pay any tax)

- The whole of the profit on the shares will be subject to capital gains tax rather than income tax. Capital gains tax will almost certainly be lower than income tax because:

- The first £3,000 of an individual’s capital gains in a tax year is free from any tax.

- Capital gains tax rates are 10% at the basic rate and 20% at the higher or upper rate (compared to 20%, 40% and 45% for income tax).

- There is no national insurance to pay on capital gains.

- Under certain circumstances it is possible that any taxable capital gain will qualify for Business Asset Disposal Relief (see separate technical briefing on this subject) and so only be subject to tax at 10%.

An employee cannot be granted options over shares worth more than £250k (again, based on the “unrestricted” market value of the shares at the time the options were granted). If this limit is breached then no further options can be granted to that employee for a period of three years.

Alternative employee share schemes

EMI is by far the most common scheme for small, unlisted companies but there are other schemes out there such as the Save as You Earn scheme (SAYE) and the Company Share Option Plan (CSOP). Please look out for future technical briefings covering these areas.

Who qualifies?

For a company to be able to issue EMI options it must meet certain qualifying criteria including:

- It mustn’t be under the control of (i.e. more than 50% owned by) another company.

- It’s gross assets must not exceed £30m at the date of the grant.

- It’s trading activities must be conducted wholly or mainly in the UK.

- It must operate a qualifying trade (most trades will qualify but please ask us about exceptions).

- It must have less than 250 employees.

A company cannot grant options over shares worth more than £3m (based on the “unrestricted” market value of the shares at the time the options were granted).

For an employee to qualify to receive EMI options they must, throughout the life of the option (i.e. grant to exercise):

- Be employed by the company (or a subsidiary of the company) granting the option.

- Work at least 25 hours a week or at least 75% of their working time in the relevant company.

- Not control more than 30% of the ordinary share capital in the company (at the date of grant only).

What do I do next?

If you’re interested in finding out more about the EMI share option scheme give Matthew Gambold a call on 0207 183 6088 or email him on matthew.gambold@chadsan.com. The most important first step in setting up an EMI scheme is to write the rules of the scheme. These can include:

- Which of your employees qualify for the scheme.

- How long will the options have to be held before they can be exercised.

- Do the option holders have to meet any other, internally defined, targets to qualify for the options.

- What happens to any shares purchased under an option scheme if an employee resigns or is dismissed.

We will discuss with you the specialist software we recommend using to draw up these sorts of agreements and have worked successfully with a number of our clients in the past. Following the conversation we can help you with:

- Performing a valuation of your company to understand the market value of the EMI options issues under the scheme.

- Applying for approval from HMRC for the market value of any EMI options issued under the scheme.

- Pulling together the agreements for the EMI options for grant, which must be done 90 days after HMRC’s valuation approval.

- Notifying HMRC of the details of any grant of EMI options by 7th July after the end of the tax year in which the EMI options were granted.

- Submitting an annual return of EMI details by 7th July after the end of each tax year.