Incorporation of Property Investments

Property investments can take many forms and are taxed very differently through a corporate vehicle than they would be if the assets were held personally. This paper aims to highlight the main differences and reach a general conclusion as to which of these should drive the decision whether to incorporate or not.

Tax on income

Generally the income generated by a property investment will be the rent receivable from the business or private tenants of the property owned. The taxable income will be offset by allowable costs such as maintenance costs, buildings insurance, finance costs (loan interest) and letting fees.

If the property is held by a company, then this income will initially be subject to corporation tax at a rate of 20%. If the post-tax profits of that company are to be distributed to its shareholders a further personal tax charge on dividends will arise if they are higher rate taxpayers or top rate taxpayers. There is no national insurance to pay on dividend income.

If the property is held by an individual then it will be taxed at that individual’s marginal tax rate of 20% (basic rate), 40% (higher rate) or 45% (top rate). There is no national insurance payable on rental income.

Tax on capital transactions

Capital taxes can arise when in asset (in this case land & property) is disposed of. The capital gain or loss is broadly calculated as:

Proceeds from sale –> Less Associated costs of sale (solicitor fees etc.) –> Less The cost of any capital improvements whilst the asset has been owned –> Less Cost of acquisition and any associated fees (stamp duty etc.)

If a company makes a capital gain on disposal of an asset then that gain is subject to corporation tax at 20% but (as with income) if the post-tax gains of are to be distributed to the company’s shareholders a further personal tax charge on dividends will arise if they are higher or top rate taxpayers. There are certain circumstances when a residential property disposal by a company can be taxed at 28%. Please contact us if you need advice.

If an individual makes a capital gain on disposal of an asset then it will be taxed at that individual’s marginal tax rate of capital gains tax which is 18% (basic rate) and 28% (higher or top rate). There is no national insurance to pay on a capital gain.

As well as the differences in tax rates however, there are also certain allowances and reliefs that may be available for individuals but not for companies (and vice versa). These include:

- Principle Private Residence Relief (PPR), which is available to individuals if the property has at any time been their main residence, but is not available to companies

- Letting Relief, which is available to individuals who are in shared occupancy with a tenant, but is not available to companies

- Annual capital gains allowance, which for individuals will exempt the first £6,000 (3000 in 2024/25) of capital gains in any one tax year from a tax charge, but is not available to companies

- Indexation allowance, which for companies will increase deductible costs in line with inflation for the period the asset has been held, but is not available to individuals

Finally, we have only looked so far at the different tax treatment of capital gains made on disposals. If a capital loss is made then an individual can usually only set that loss against capital gains made in the current or future years. They cannot set it against rental income or any other type of earned or investment income.

Similarly a company can only usually set capital losses against capital gains in the same or future accounting periods.

If you are considering transferring privately owned property to a corporate vehicle that is owned and / or controlled by you or your close relatives it should be considered that this is likely to be treated as a market value disposal and so crystallise a capital gain or loss. The same would apply if the transfer were to happen the other way around.

Stamp Duty

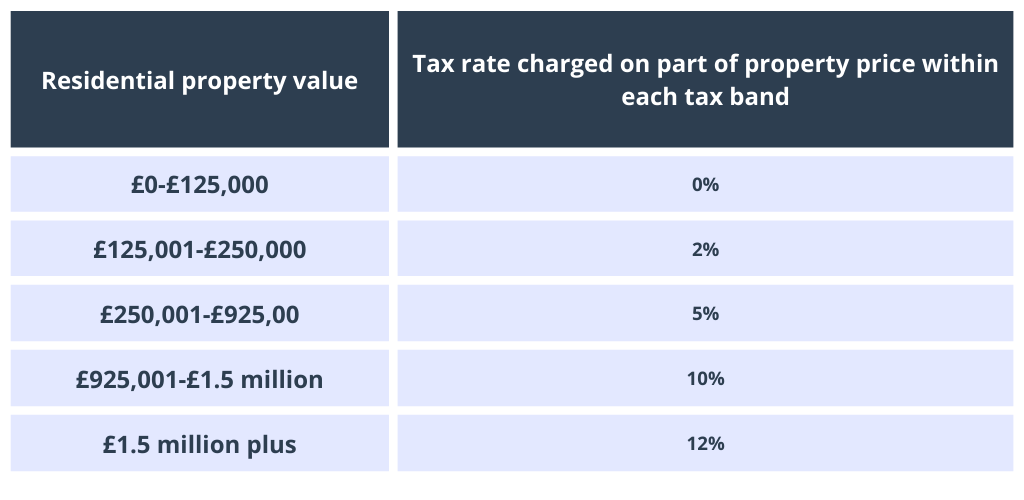

Whenever a property is purchased stamp duty will be payable by the acquirer (be it a company or an individual) at the following rates:

If you are considering transferring privately owned properties to a corporate vehicle it should be considered that stamp duty will be payable by the company on the market value.

Annual tax on enveloped dwellings (ATED)

High value (£500K plus) residential properties owned through a corporate vehicle are subject to additional tax liabilities and compliance obligations designed to mitigate against tax avoidance schemes. There are various reliefs that could reduce the tax liability to zero but this is outside the scope of this briefing.

If you believe you may be effected please don’t hesitate to contact us to discuss further.

Practical Implications

If loan or mortgage finance is required to acquire the property investment it is likely to be considerably more difficult and expensive to obtain that through a corporate vehicle, particularly if that vehicle has limited or no assets / trading history. If such finance is sought then professional advice from a mortgage advisor should be taken.

Conclusions

As can be seen from the above summary there are many issues to be taken into consideration when deciding whether to manage property investments directly or through a company.

Each situation should be taken on its own merit but as a general guide, because of the lower tax rates (for undistributed profits) but shortage of reliefs for capital disposals, acquisitions through a corporate vehicle would only normally be suitable to manage complex investments with multiple stakeholders or as part of a longer term investment strategy. Normally the general intention for such companies would be to reinvest income generated and distribute the accumulated reserves of the company further down the line when it is most tax efficient to do so.

If you are looking at making a new property investment or at re-organising your existing portfolio please give us a call or get in touch via email.