5 Things you need to know about pensions

Pension schemes are long-term savings plans that help people set aside money for their future, especially for when they stop working and retire. These schemes are designed to ensure that individuals have a steady income even after they stop working, allowing them to maintain their financial stability during their retirement years.

In this blog, we will unravel the mystery surrounding pensions and present you with five crucial things you need to know about them.

1. Why should I contribute to a pension scheme?

Pension schemes are a simple method for ensuring financial stability in the future. They help people save and invest money during their working lives. Subsequently, individuals can utilise their accumulated pension funds to enjoy retirement.

In addition, you should contribute to a pension scheme as it enables you to save tax during your working life.

Finally, under current legislation your employer will most likely have to set up and contribute to a pension scheme for you (unless you opt out). This is usually in addition to the money you contribute.

2. Terminology

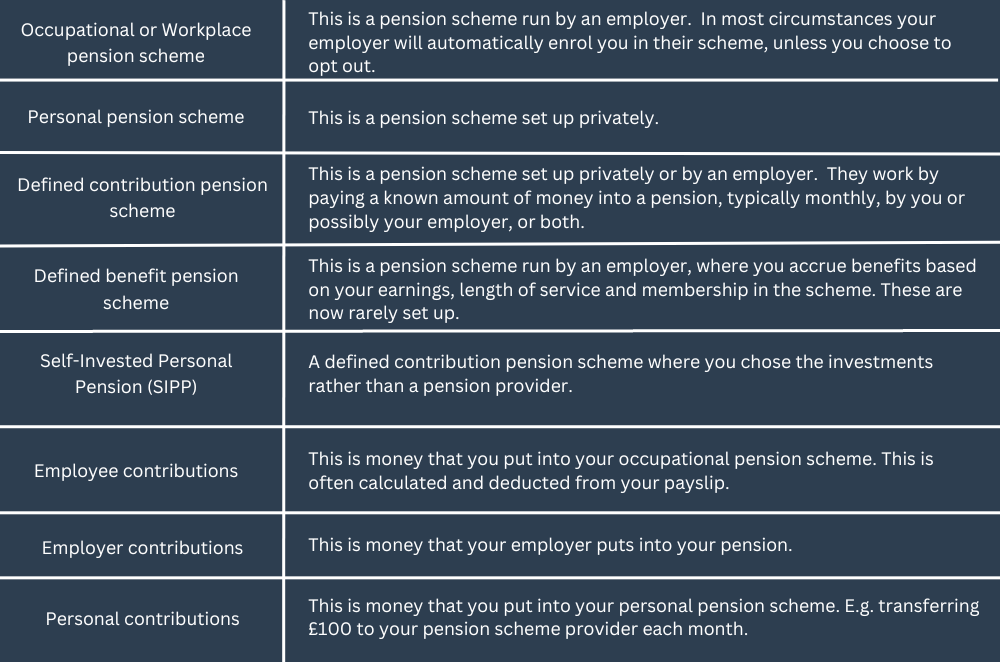

Unfortunately, pension schemes are not one-size fits all. They come in different shapes and sizes. It is important that you understand which pension scheme you have and the differences between schemes. Firstly, let us look at some important terminology.

Please note, occupational schemes can either be defined contribution or defined benefit. However, personal schemes can only be defined contribution. Defined benefit schemes are now very rare.

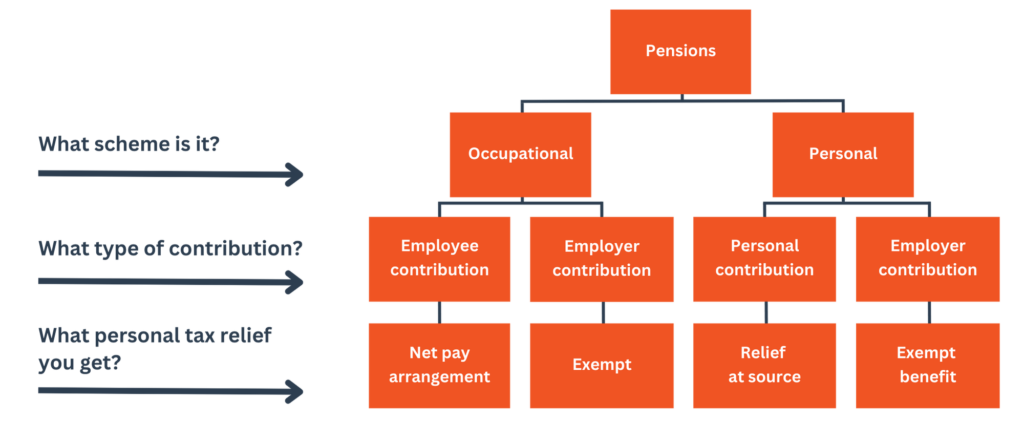

3. What personal tax relief do I get?

The type of personal tax relief you obtain depends on your scheme (Occupational vs Personal) and the type of contribution (employee vs employer vs personal) you make.

Net pay arrangement

If you make an employee contribution to your occupational pension scheme, then you will receive tax relief under the net pay arrangement. You should deduct your contribution from your employment income BEFORE calculating income tax.

E.g. Jack works for A Ltd and has a gross salary of £30,000 per annum. He pays £100 to his occupational pension scheme each month. Jack will only pay income tax on £28,800 (£30,000 – £100*12) per annum.

Exempt benefit

You do not receive any personal tax relief when your employer contributes to your occupational or personal pension scheme.

E.g. Jack pays £100 into his pension scheme each month. His employer (A Ltd) matches this contribution and contributes an extra £100 per month to his pension. Jack will not receive any extra income tax relief on this employer contribution.

Relief at source

If you make a personal contribution to your personal pension scheme, then you will receive tax relief under the relief at source basis. Follow these steps:

- You will gross up the contribution by 100/80. This is called the gross personal contribution. Please note, the extra 20% is paid into your scheme by HMRC.

- Extend your income tax bands by your grossed-up contribution (effectively you pay tax at lower rates for more of your income).

E.g. Jack has decided to put £5,000 into his personal pension scheme. HMRC will pay an extra £1,250 (£5,000*20/80) into Jack’s pension. Jack will extend his basic rate band and higher rate band by £6,250 (£5,000*100/80).

4. Do I need to consider anything else?

Limit on tax-relief

Be careful! If you contribute too much to your pension scheme in any tax year, you will stop getting tax relief. The maximum amount of income that an individual can receive tax relief from is the higher of:

- £3,600

- Relevant earnings (your employment income + your sole-trader profits)

You will not obtain tax relief if your ‘employee contributions + gross personal contributions’ exceed the maximum explained above. You should seek advice if this is the case.

Limit on pension contributions per year

The annual allowance represents the limit for how much can go into your pension scheme in any tax year. The annual allowance is £60,000 (£40,000 for 2022/23 and previous tax years). Any unused annual allowance can be carried forward 3 years. Please also note, your annual allowance is reduced if you are a high earner.

If ‘employee contributions + gross personal contributions + employer contributions’ exceed the annual allowance, then you will be subject to an annual allowance charge. You should seek advice if this is the case.

5. Common misconceptions

- Pension contributions reduce your National Insurance Contributions.

- No, contributing to your pension will not impact how much national insurance you pay as an individual.

- My workplace has helped me set up a pension scheme, it must be an occupational one.

- No, you should confirm this with your pension scheme provider.

- All schemes get the same tax relief.

- No, we have already seen above that different schemes attract different reliefs.

- I can put as much as I want in my pension without any consequences.

- No, you will lose tax relief and potentially become subject to charges.

- Pension schemes are risky

- As with any investment opportunity, there is always a risk. However, many pension scheme providers will allow you to choose the risk level and what your money is invested in.