IR35

What is IR35?

The IR35 rules have been around since April 2000 and were designed to prevent ‘disguised employment’. This is where a contractor works in a very similar manner to their client’s employees, but they use an intermediary such as a limited company (often referred to as ‘personal service companies’ or PSCs), meaning PAYE and NICs aren’t paid and instead the contractor will pay dividend tax rates and/or corporation tax on profits, which can be more favourable.

A contract between a worker and their client is deemed ‘inside IR35’ if that worker should be on the client’s payroll were it not for the PSC. If the contract is inside IR35, then PAYE and NICs will apply. A contract is ‘outside IR35’ if the worker is more like a freelancer and would otherwise be self-employed were it not for the PSC.

If a worker is not operating via an intermediary then IR35 doesn’t apply as IR35 doesn’t apply to PAYE employees, PAYE-compliant umbrella contractors, or sole traders – although the criteria to determine whether a contract is within IR35 or not are the same to determine whether a sole trader should in fact be a PAYE employee.

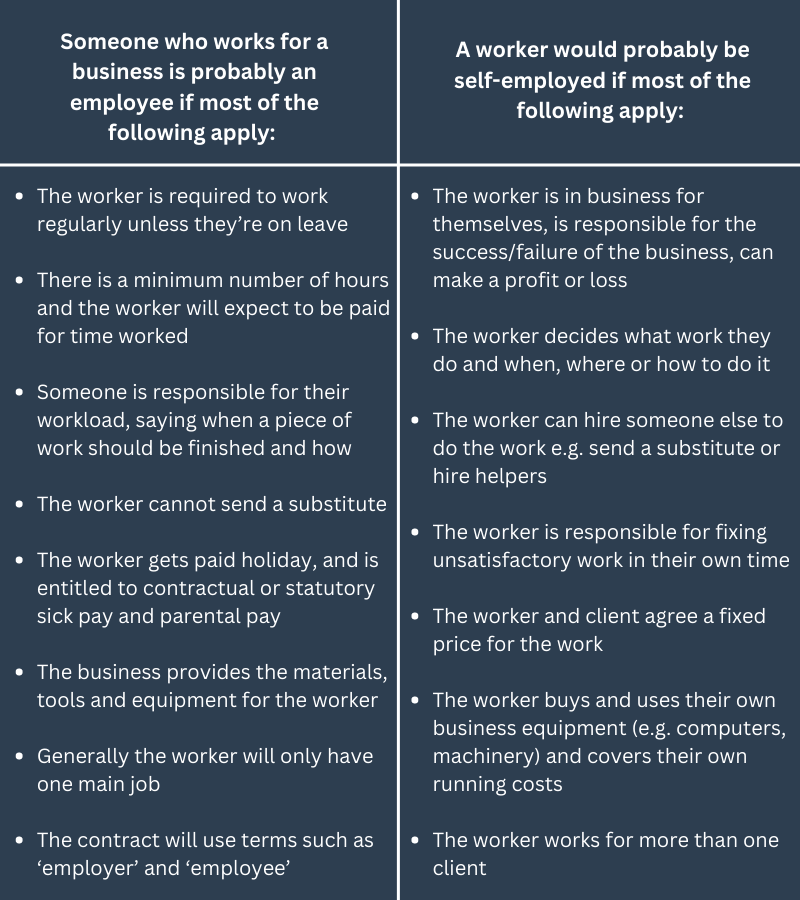

What determines employment vs self-employment, and therefore whether a contract is ‘inside’ or ‘outside’ IR35?

This can be a grey area with HMRC and a holistic view is taken, although some of the below factors can swing the decision one way or another:

It’s not just the nature of the contract that matters, it’s the true nature of the work performed. HMRC have a status checker you can try yourself here

What’s new in April 2021?

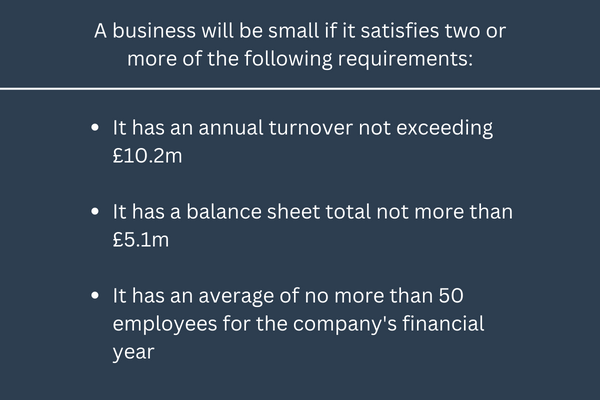

The change from April 2021 (pushed back from April 2020 due to the Covid-19 pandemic) means that where before it was up to the PSC to work out the nature of the contract, now the client has to be the ‘decision maker’ and make that determination where the client is a medium or large company. If the client is small, then the responsibility remains with the PSC as before.

Where a medium-sized or large-sized business determines a contract is within IR35, PAYE and National Insurance must be deducted from the contractor’s fee by the ‘fee payer’. Where the client engages contractors directly the client is both the ‘decision maker’ and the ‘fee payer’. Where there are agencies in the chain, the agency responsible for paying the contractor’s company will be the fee payer in this case.

The client must provide a ‘Status Determination Statement (SDS)’ outlining whether the contract is inside or outside IR35, and the reasons behind this decision. As a contractor you have a right to dispute the decision if you don’t think it’s correct.

So if I’m a contractor working inside IR35, what does this mean for me?

If you do accept a contract via your PSC to take on a contract inside IR35, then it means your company will receive the fee net of income tax and NICs. Don’t worry – the net amount paid to your company won’t then be double taxed as you can take the income from your company tax-free, but there are reporting requirements for the financial statements of your company, for payroll purposes, and for your self-assessment tax returns. It’s important to keep hold of all documentation, particularly your P60s, so your accountant can ensure the filings are timely and accurate!

The alternative options are that the client might put you on their payroll, or they might ask you to work for an umbrella company. In both these cases you do not need to worry about IR35 as you will be paid as an employee.

I set up my limited company so I could be tax efficient, is IR35 worth it anymore?

If you only have IR35 contracts then it might be the case that you no longer need your limited company. If you have a mixture of contracts there could still be benefit to keeping your company open. It entirely depends on each individual’s circumstances so we recommend getting in touch to discuss further!